Goldman Sachs and Ray Dalio warn of Bearish Future on the Horizon

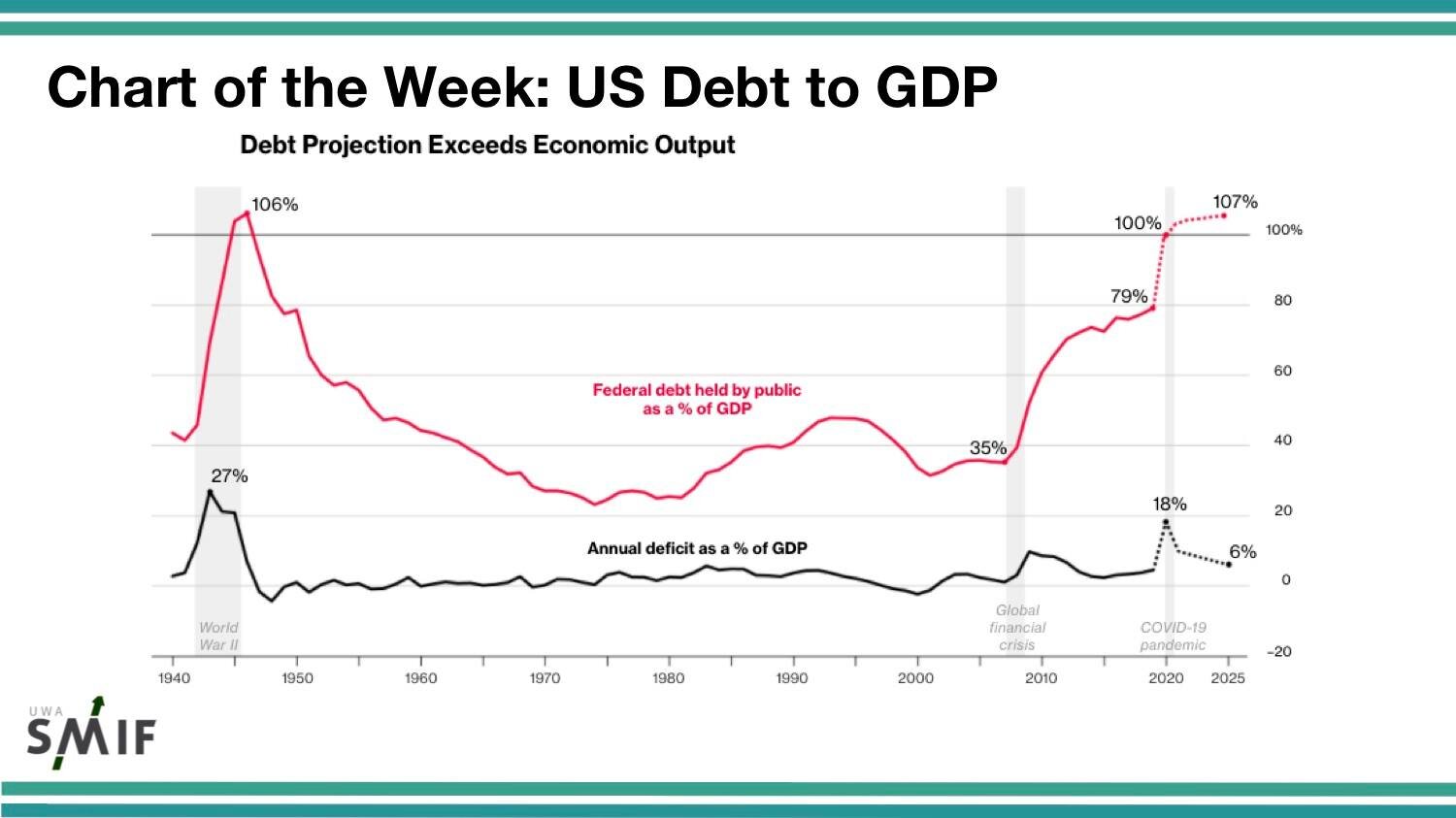

Big names in finance have recently warned the world of a bleak future on the horizon after the US has experienced the second longest economic expansion on record. In a recent interview with Bloomberg, Ray Dalio expressed his concerns of an economic downturn in the next two years. According to Dalio, as the fiscal stimulus tapers off, higher interest rates, slower credit growth and unfunded government liabilities pose risks to the US economy.

Goldman Sach’s Market-Risk Indicator is at its highest since 1969. The indicator is designed to provide a reasonable signal for future bull and bear markets. The indicator considers equity valuation, growth momentum, unemployment, inflation and the yield curve. Goldman Strategist Peter Oppenheimer wrote that a long period of low equity returns is most likely.

President Donald Trump Proceeds with $200 billion of Tariffs

President Trump instructed tariffs of $200 billion on Chinese products last Thursday despite Treasury Secretary Mnuchin’s attempts to restart negotiations with Beijing. However, the latest round of tariffs has been delayed as the administration considers the limited amounts of products which would have a significant impact on US consumers and major companies. So far, the Chinese have retaliated with tariffs on an equivalent amount of US exports and promised to match the US tit-for-tat.

Apple said last week that the $200 billion round of tariffs could hit its products such as the Apple Watch and AirPods Headphones. Big retailers also such as Target and Walmart could also be sucked into the trade war as the new round of tariffs may be allocated to consumer products ranging from shoes to TVs.

Officials from both countries have met four times for formal talks to end disputes, most recently in August. All efforts so far have fizzled. Washington has sought to put pressure on Beijing to reduce its trade surplus and protect the intellectual property rights of US companies.